HOW THE SECURE ACT CHANGES KEY DISTRIBUTION RULES

August 13, 2024

Paragraph

Paragraph

Paragraph

The Setting Every Community Up for Retirement Enhancement Act, better known as the SECURE Act, was specifically designed to help more people save more money for their retirement. Version 2 of the act was signed into law last year. This summer, the IRS published the final version of its regulations for required minimum distributions.

We agree wholeheartedly that saving more for retirement is a good thing.

That said, these regulations are complex. Very, very complex. They include changes that will probably affect—or have already affected—your retirement, and your legacy and estate planning.

We’re here to help. We’ve broken down specific elements of the SECURE Act in three blog posts:

- What you need to know about the SECURE Act 2.0

- What happened to my stretch distributions?

- Should I make a trust the beneficiary of my IRA?

Some of the latest updates are particularly complicated. Want the short version? Skip ahead and look at the charts, and then come back to read for more context, definitions, and details.

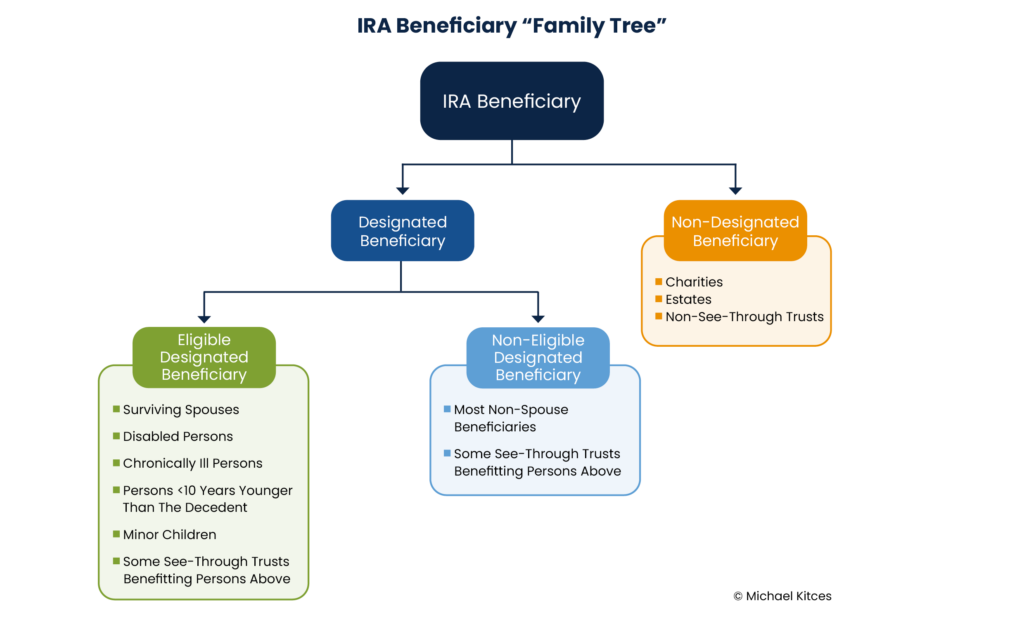

Defining Beneficiaries

The context you’ll need: people formerly defined by the government as designated beneficiaries were divided into two groups: eligible and non-eligible. Then, those groups were divided again into more groups.

Ugh, definitely complicated. To make it as simple as possible, here’s a chart that shows the groups:

SOURCE: Michael Kitces at Nerd’s Eye View

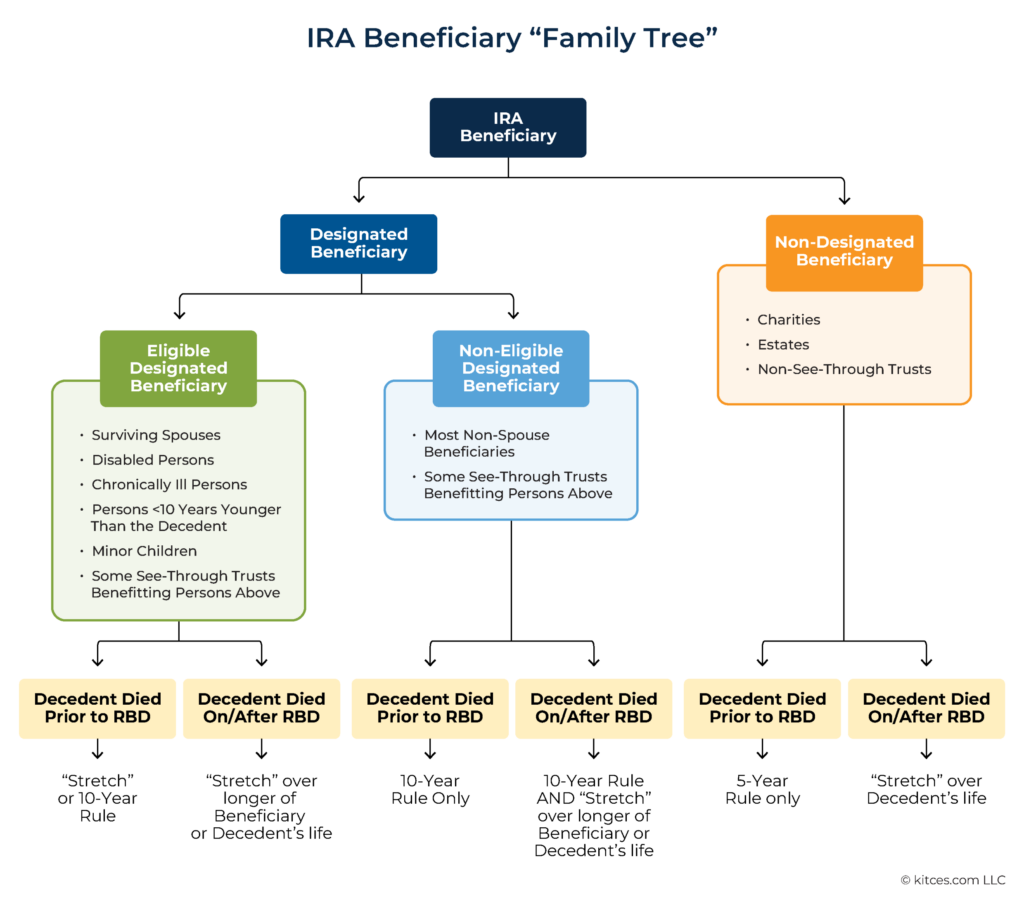

Different Rules for Different Beneficiaries

There are many different rules that beneficiaries must follow. Oh, and the IRS added penalties for those who don’t comply. Fun.

The 10-Year Rule. If the 10-Year Rule applies, it means that an inherited retirement account must be fully distributed to its beneficiary within ten years after its owner’s death. Another way to say this: the inherited retirement account must be emptied by the end of the tenth year after the year of the owner’s death. But, there are rules within that rule. Some beneficiaries just need to empty the account within those ten years. Other beneficiaries need to take required minimum distributions, or RMDs, every year.

Required minimum distributions. Required minimum distributions, or RMDs, are exactly what they sound like: annual withdrawals from the inherited IRA. How much and when? That’s a good question for your estate attorney, wealth advisor, and CPA (all will weigh in).

Stretch distributions. Some beneficiaries who inherit an IRA or 401(k) can still take distributions “stretched” over their lifetime.

5-Year Rule. Much like the 10-Year Rule, if the 5-Year Rule applies, the beneficiary must empty the account—the account must be “fully distributed”—by the end of the year of the fifth anniversary of the owner’s death.

Required beginning date. The required beginning date, or RBD, is when most owners of IRAs have to take their first required minimum distribution. For many, that is when they turn 73.

More classifications. The IRS decided to add two more ways of defining beneficiaries: those who inherited from a person who passed before that person’s required beginning date and those who inherited from someone who died after their required beginning date. You’ll see how this applies in the chart below.

This chart sums up some of the core changes:

SOURCE: Michael Kitces at Nerd’s Eye View

An important caveat: this is a simplified explanation of a complex series of laws, rules, and regulations. As always, there are exceptions to every rule. There are many more nuances and changes—and additional regulations to come.

We’re here to help keep you up-to-date on changes that affect you and your legacy. To find out how the new regulations will affect you and your estate plan, contact us to set up a consultation.

For more peace of mind, sign up for JM LAW CARES. All of our clients are eligible for membership in our CARES estate and legacy planning maintenance program. We designed it specifically to help you keep your estate plan up-to-date through changes like this. For more information, see our overview of the JM LAW CARES program or contact us to apply.

This post was created by Jessica Marchegiano, founder of JM LAW and senior estate planning attorney.

Serving clients throughout Virginia, Maryland, and Washington, D.C.

Disclaimer: Materials prepared by JM LAW, PLLC are for general informational purposes only. Educational material does not create an attorney-client relationship and is not an offer to represent you. You should not act or refrain from acting based on information provided.

©2025 JM LAW, PLLC. All rights reserved

site credits : photography

8180 Greensboro Drive, Suite 1100 | McLean, VA 22102 | (703) 956-5738